Premium paid - The amount of money you have paid for the insurance policy.

Guaranteed Maturity - The amount of money which is guaranteed return to you after the policy reach the end of its term (matures), unless the insurance companies go burst.

Non-guaranteed Maturity - The amount of money which is not a MUST to be returned to you after the policy matures. The return may depends on factors like market condition.

So I was introduced to an endowment plan called SavvySaver which was told by the financial planner, will generate a return of 3.25% to 4.75% per annum. I have not much knowledge about endowment plan and just by listening to this, I thought it was not a bad plan considering that the current interest rate in the bank is less than 1% per annum. However, as my cash is deposited in OCBC 360 current account which gives a maximum interest rate return of 3.05% per annum if you fulfil all 3 of its conditions every month (which I always did), the endowment plan must generate a return of at least 3.05% before I will consider it.

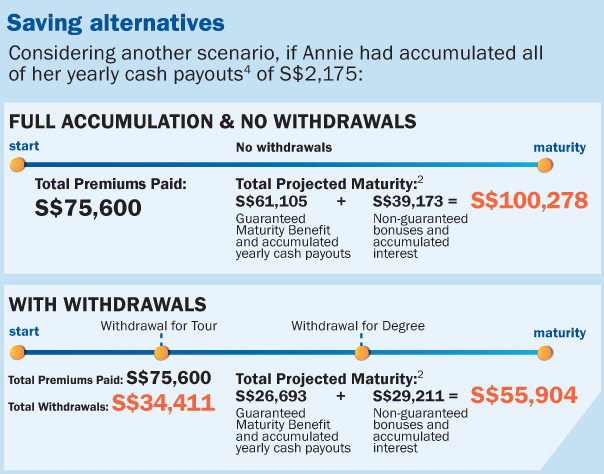

On further investigation, I realised that the return is actually much lower. The image below is taken directly from the insurance company's website explaining to us how the plan actually works.

As I have said before that I don't have much knowledge about endowment plan, please pardon me if I have calculated wrongly and would appreciate readers could point out my mistakes so that I can learn from it. We will only discuss the top portion of the scenario given in the image where there is full accumulation of premiums paid with no withdrawals at any point of time. This is because if there is with withdrawals, the return will be even lower.

The Total Projected Maturity of $100,278 is based on the following scenario:

Monthly premiums paid: $300

Duration: 21 years

Non-guaranteed bonus of $39,173: base on projected investment return of 4.75% per annum on the participating fund that the insurance company invest in. (This means that if the insurance company use your money to invest and the return is less than 4.75%, your non-guaranteed bonus and accumulated interest will be lesser)

So lets start with the calculation:

Every month you will be paying $300 for 21 years. So the total premium you have paid after 21 years is calculated as: $300 x 12months x 21years = $75,600

Ok now look at the image above. Have you notice something? Under the total projected maturity, the guaranteed maturity is only $61,105. You have saved up $75,600 for 21 years but in the end, they only guaranteed you a return of $61,105? This means that you are not even guaranteed the capital amount of $75,600 that you have put in. So what happen with the difference of $14,495 ($75,600-$61,105) that you have put in? After further investigation, I realised that this policy also comes with a basic life insurance plan. Most probably, the difference is paid for the basic life insurance plan (low coverage), administrative fees and agent commission.

Now lets calculate the effective return per annum, taking into consideration all the cost involved. The Total Projected Maturity is $100,278 after 21years based on the scenario mentioned above. So after 21 years, you have actually gained $24,678 ($100,278 - $75,600). Now we shall calculate the percentage return per year. This is calculated by:

($24,678/ $75,600) / 21years = 1.56% per annum

The return per annum is a measly 1.56%. This is lower than my expected return of 3.05%. This is not even higher than the average annual inflation rate. This is also definitely not the same as what was expected of a return of 3.25% to 4.75% per annum. Furthermore, the return of 1.56% depends on the insurance company being able to generate a return of 4.75% annum. You bear the risk of having even lower return if the insurance company couldn't generate a return of at least 4.75% per annum.

Cheers~